News

6 Budget Revision Ideas for Empty Nesters

After years of seemingly endless school events, grocery bills that could feed an army, and the hustle and bustle of family life, your house has suddenly become quiet. You’ve become empty nesters. You must adjust your spending and budgeting habits along with this significant lifestyle change. Let’s dive into how to revise your budget when you become are empty nesters.

The Greatest Money Making Asset For Working Teens

In this article, we explore why a Roth IRA is one of the greatest money making assets for working teens. When working teens invest early in a Roth IRA, they can contribute to a strategy that could accumulate millions later in retirement. Working teens can contribute to a Roth IRA when a parent or grandparent opens the account. A Roth IRA can be opened at any age if a child has income. For example, if your five-year-old child was a model for a local store and received a paycheck in their name, the amount received can be contributed to a Roth IRA.

Holiday Season Deplete Your Savings? Here’s How to Recover

If you’re like many, overspending during the holiday season may deplete your savings. It is important for you to recover your savings so you’re financially prepared for unexpected expenses. Here are tips to help you spend less and send more money to your savings:

Could Inflation Be a Friend and Not a Foe?

When inflation increases, people often feel the sting of paying more for groceries, gas, and almost everything else. Many may feel inflation is terrible because their paychecks are shrinking, and they don’t like paying more for the same items. But inflation also has positive benefits that may occur over time, such as:

How Pets Could Impact Your Taxes

Many view pets as part of their family and essential to their happiness and mental health. Pets can be an added expense as they may need special diets. Or even require veterinary services, and in some cases, pet daycare.

How Debt Holds Families Back from Financial Confidence

Debt can hinder financial confidence when you spend more than you make and borrow using credit. Other financial problems may occur, such as inadequate emergency or retirement savings.

10 Actions That Help You Pursue Financial Wellness

Establishing financial wellness is a personal, ever-changing state of being that enables one to exercise choice while feeling in control of finances.

The individual determines financial wellness, which often includes working toward financial goals by completing specific actions. Some actions are time-sensitive, but others can occur anytime throughout the year. Here are ten actions that may help keep your finances on track as you pursue financial wellness:

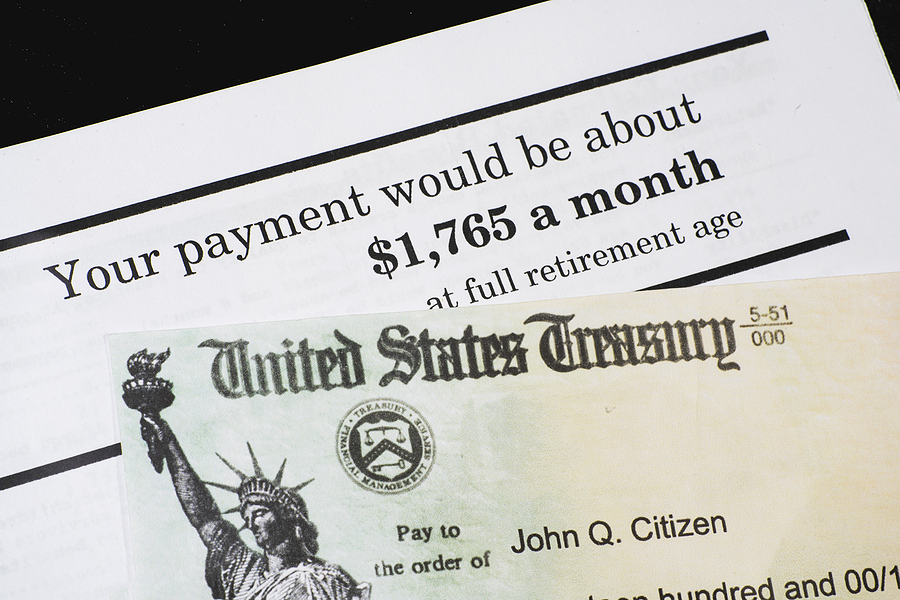

When Can You Collect Social Security?

Knowing the situations and critical ages of when to start Social Security benefits is essential. The age when you start to collect social security benefits impacts the amount you receive.

Why Wealth Management Is Important for Women

Today, women control a third of household assets one major reason why wealth management is important. But by 2030, U.S. women are expected to control much of the assets that the baby boomer generation will pass to heirs; roughly 30 trillion in assets.

Social Security COLA May Be Less in 2024

For 2023, Social Security Retirement and Supplemental Security Income (SSI) benefits increased due to inflation. The increase was 8.7%, resulting in an average monthly benefit increase of $146 per month for a yearly increase of $1,827 in 2023.